Reporting timelines have been cut by 40%, enabling the firm to consistently meet LP deadlines with confidence.

A top-tier pan-European growth investor managing over €2bn in assets under management (AUM), focused on backing high-growth technology businesses across the UK, DACH, and Nordics. With a strategy centered around identifying breakout companies and helping them scale internationally, the firm has built a reputation for hands-on partnership, operational excellence, and consistently strong returns.

As fund count and portfolio size expanded rapidly, so did the complexity of managing data across asset servicers, internal teams, and portfolio companies, setting the stage for a critical need to modernize operations.

The Challenge

As the firm scaled, data complexity quickly outpaced existing tools and workflows:

- Reporting pressures mounted as the team struggled to meet quarterly deadlines, driven by inconsistent data formats across asset servicers and manual internal consolidation efforts.

- Portfolio company reporting was fragmented, managed through shared folders and custom templates that led to data delays and gaps.

- Finance, IR, and Deal teams operated in silos, often relying on disconnected spreadsheets, leading to mismatched numbers and reporting inconsistencies.

- A lack of a single source of truth created confusion in internal reviews and slowed Investor communications, risking reputational trust at a critical point in the firm’s growth journey.

Aggregating and validating data

Fragmented portfolio reporting

Inconsistent data sets

Strained investor experience

The Impact

40% faster reporting

Reporting timelines have been cut by 40%, enabling the firm to consistently meet LP deadlines with confidence.

40% faster reporting

Higher data integrity

Data quality has materially improved, with errors and inconsistencies now caught and corrected early in the process.

Higher data integrity

Data quality has materially improved, with errors and inconsistencies now caught and corrected early in the process.

Fully aligned teams

Finance, IR, and Deal teams now work from the same single source of truth, eliminating reporting gaps and internal friction.

Fully aligned teams

Finance, IR, and Deal teams now work from the same single source of truth, eliminating reporting gaps and internal friction.

Stronger LP relationships

Clean, timely reporting has elevated Investor communications, strengthening trust and reinforcing the firm’s reputation for operational excellence.

Stronger LP relationships

Clean, timely reporting has elevated Investor communications, strengthening trust and reinforcing the firm’s reputation for operational excellence.

Summary

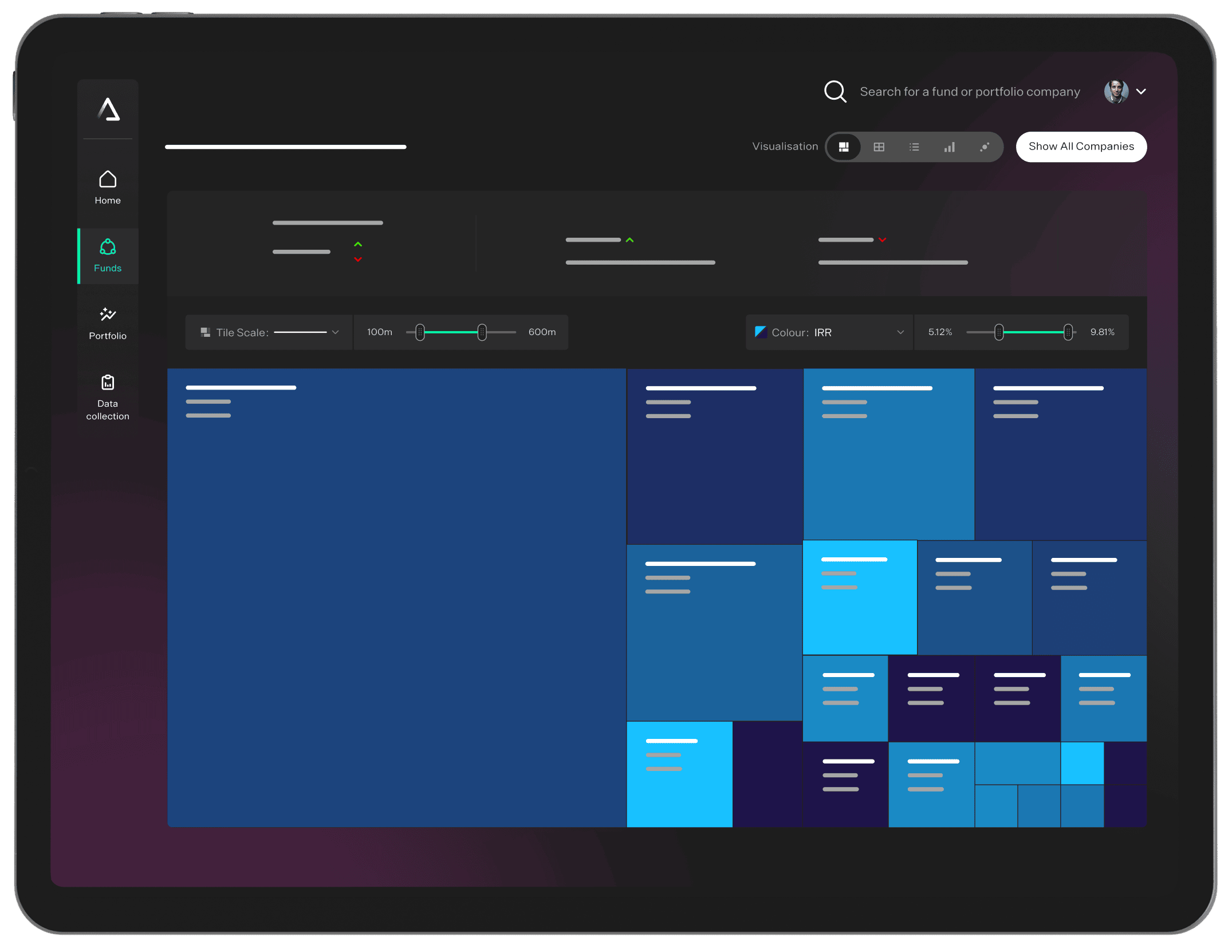

By unifying their fund and portfolio data with Lantern, this leading growth equity firm transformed reporting, strengthened LP trust, and built a scalable foundation for growth. Ready to see how Lantern could work for you? Please get in touch – we’d love to show you Lantern in action.