Shadow accounting efforts were dramatically reduced, saving days of work each quarter and freeing up internal resources for higher-value tasks.

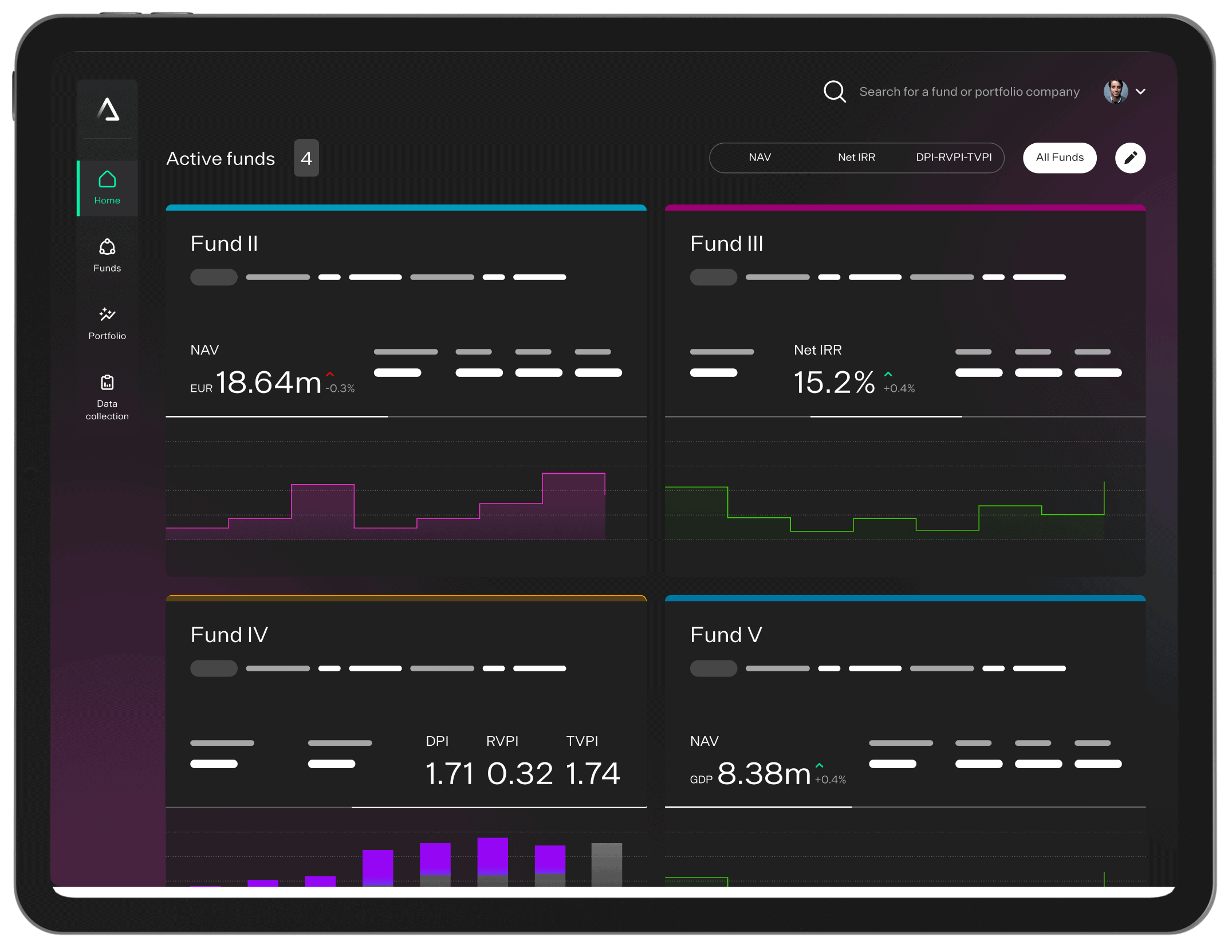

A global private equity leader managing more than €40bn in assets across Europe and North America, with a multi-strategy platform spanning buyout, healthcare, and infrastructure investments. The firm’s growth and diversification across regions and sectors brought new complexity to its fund operations – and a need for better data control.

The Challenge

As the firm expanded, internal teams faced growing operational pressure:

- Fund data arrived from four different asset servicers, each using their own accounting systems, file formats, and proprietary portals – designed to fit their tech, not the GP’s needs.

- Investor reporting relied on reconciling PDFs, Excel files, and manually re-keyed data – a slow, error-prone process that introduced significant operational risk.

- To feel confident before communicating externally, the firm built a full shadow accounting process internally – creating a major resource drain.

- With no reliable, validated input source, meeting reporting deadlines became increasingly difficult, and confidence in LP reporting suffered.

Aggregating and standardising data

Manual reconciliation and shadow accounting

Complexity of private markets nuance

Disconnected infrastructure

The Impact

Shadow accounting reduced

Shadow accounting efforts were dramatically reduced, saving days of work each quarter and freeing up internal resources for higher-value tasks.

Shadow accounting reduced

80% time saved reconciling data

Teams now spend 80% less time reconciling asset servicer feeds, with automation catching common errors early in the process.

80% time saved reconciling data

Teams now spend 80% less time reconciling asset servicer feeds, with automation catching common errors early in the process.

Faster quarter-end close

Validated data has accelerated the quarter-end close process, enabling faster reporting and greater internal confidence.

Faster quarter-end close

Validated data has accelerated the quarter-end close process, enabling faster reporting and greater internal confidence.

Fewer reporting errors

Common issues like broken capital account balances and NAV mismatches are now caught and corrected well before final reporting.

Fewer reporting errors

Common issues like broken capital account balances and NAV mismatches are now caught and corrected well before final reporting.

By partnering with Lantern, this global private equity firm eliminated operational risk, accelerated investor reporting, and built a future-proof foundation for data control across every fund, and every asset servicer. Interested in how Lantern could work for your operations? We’d love to show you Lantern in action – get in touch.