Introduction

Private markets are moving faster. LPs expect more detail, more often and they expect the numbers to actually hold up. The problem isn’t just data volume. It’s private markets data management, having numbers you can trust.

Day to day, numbers across fund administrators, internal systems and reporting tools appear aligned – at least at a glance. It is only when a fundraising process, audit, or reporting deadline forces deeper checks that cracks appear. Conflicting data surfaces between administrator outputs, internal CRMs, Excel models, portfolio systems, and investor statements especially when multiple administrators are involved.

Complexity stacks up quickly. Each extra admin, side vehicle or tracker adds another set of files, formats and reconciliation steps that sit with the finance team. In the textbook world of “Company XYZ” and its perfectly reconciled widgets, everything ties. Real fund finance is rarely that kind.

This isn’t just annoying. It’s LP Exposure

MSCI’s recent GP survey found that one in three managers say they lack access to private asset data they fully trust. Across the industry, 52 to 68 per cent of GPs rank managing investor expectations and reporting requirements among their top challenges, with many citing client-specific reporting demands and the need for highly granular reporting. For larger GPs, 41 per cent highlight bespoke LP reporting as a major issue, while a third of smaller GPs say investors now expect highly detailed, granular reports as standard.

When the underlying data is inconsistent, this pressure translates directly into LP exposure. Misstated or restated capital accounts, adjusted performance numbers during diligence, delayed reporting cycles and a perception that internal controls are weaker than they should be all have a reputational impact. On paper, Company XYZ always discovers the missing widgets before year-end. In private markets, you often find them halfway through an LP due diligence pack.

From chaos to clarity

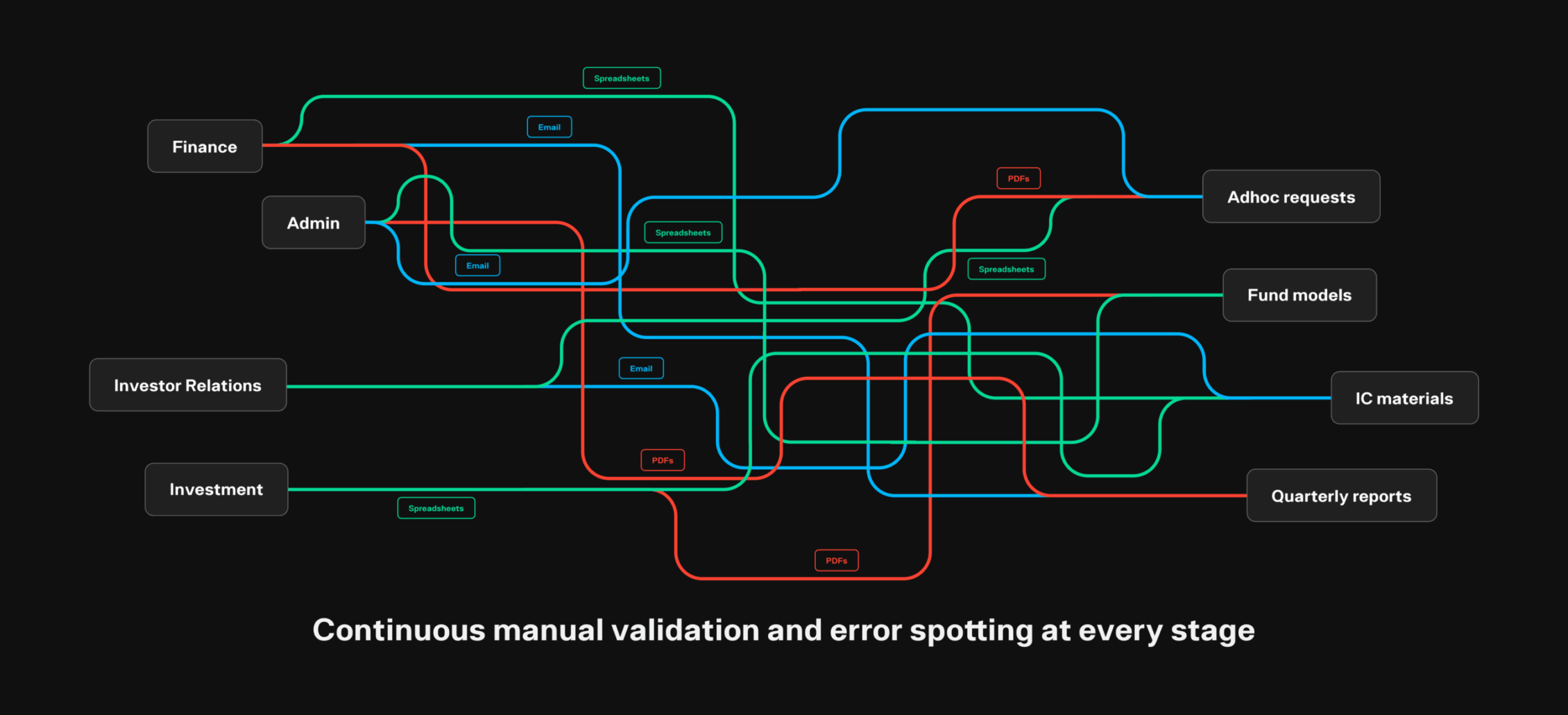

Figure 1: Today’s reality for many funds

Multiple administrators and internal tools feeding overlapping spreadsheets, trackers and portals, with reconciliation work scattered across teams. Knowledge lives in inboxes and good luck with any controls.

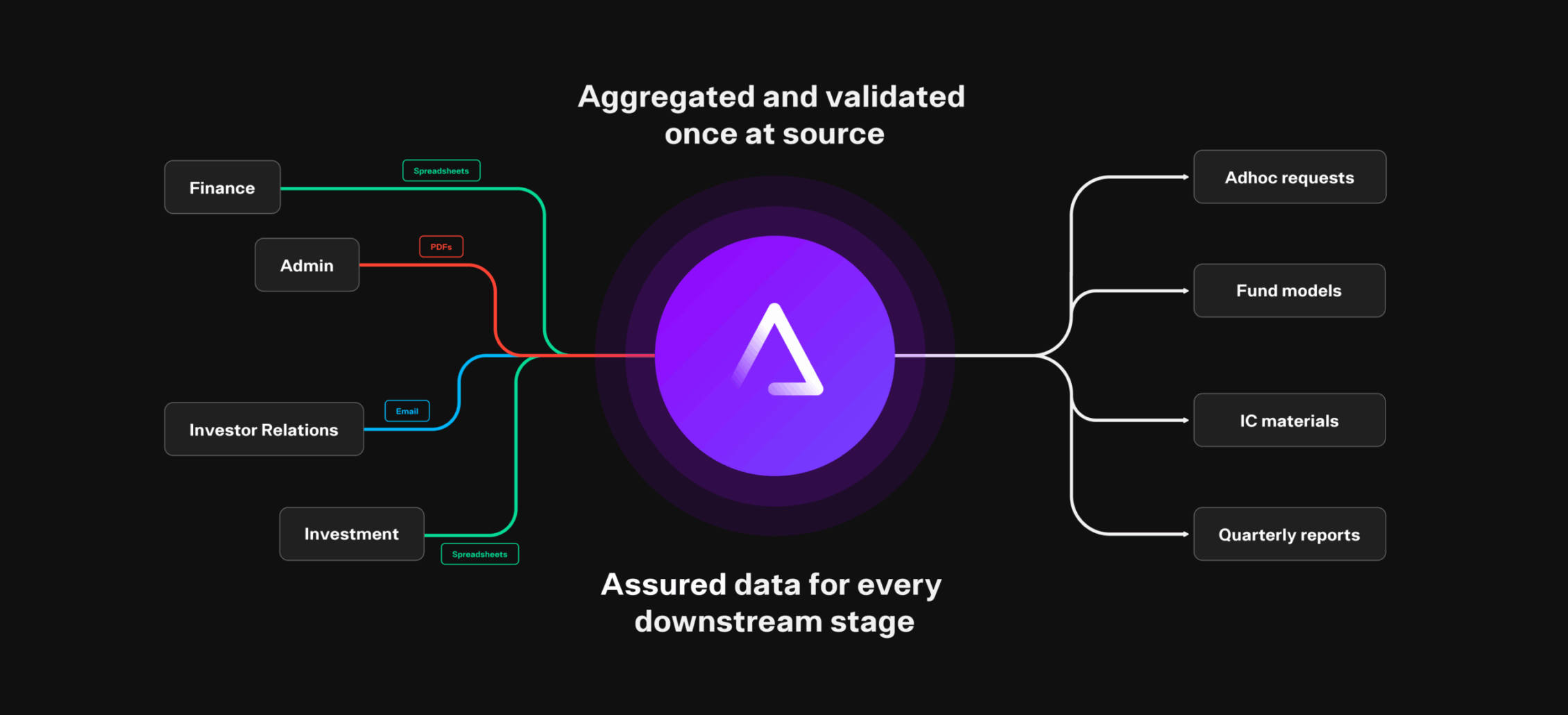

Figure 2: The better way

A single, trusted data model that ingests administrator outputs, documents, APIs, and internal systems into one Core Model for funds, entities, and portfolio companies, with thousands of automated tests checking completeness, accuracy, and consistency, and full version control for auditability. Put simply, numbers you can trust.

How Lantern helps

At Lantern, we focus on helping funds make that second picture the norm. Lantern unifies, standardises and validates fragmented data from administrators, spreadsheets, internal trackers, and point solutions into a single, administrator-agnostic platform. It turns messy inputs into reconciled outputs and investor-ready insights without requiring you to run a parallel accounting system.

Our Core Model and automated data quality checks reduce the need for shadow accounting, support near real time fund data, and give finance, IR, and operations teams one place to answer LP and internal questions with confidence.

What changes for fund finance leaders

With a stronger private markets data management foundation teams, can:

- Validate data instantly across systems instead of rebuilding the story in spreadsheets

- Cut manual spreadsheet-based reconciliation and reduce shadow books

- Shorten the time required to prepare capital accounts, statements and LP reports

- Strengthen data lineage, financial controls and audit readiness with numbers that hold up.

Private markets are asking for more; faster diligence, more bespoke reporting, and greater transparency – often for a wider investor base.

That only works when you have a data foundation you can trust. If your reporting still runs on shadow books and reconciliations at 2am, the issue isn’t your team it’s the data journey. Lantern brings clarity to that journey, so you can move faster with confidence.